Introduction

In the fast-paced world of blockchain, Avalanche (AVAX) has emerged as a game-changer, challenging established platforms with its unprecedented speed, affordability, and flexibility. Built to rival giants like Ethereum, Avalanche promises more than just another blockchain – it offers a dynamic ecosystem that powers decentralized finance (DeFi), NFTs, gaming, and beyond.

But what exactly is Avalanche, and how does it work? From its unique subnetworks to its game-ready infrastructure, Avalanche brings a new level of performance to decentralized applications.

This guide unpacks Avalanche’s innovative structure, key use cases, and the ways it’s redefining the digital landscape. Discover how Avalanche's tokenomics generate value, explore real-world applications, and see why it’s a top choice for developers and users alike.

What is Avalanche (AVAX)?

Avalanche (AVAX) is an innovative blockchain platform that was launched in 2020 by Ava Labs. Its main goal is to make blockchain technology faster, more scalable, and easier to use. With its three connected blockchains, Avalanche allows quick creation and exchange of assets, runs smart contracts, and coordinates the network efficiently.

One of the standout features of Avalanche is its energy-efficient Proof-of-Stake system, which uses less energy than older blockchains like Bitcoin. This flexibility enables developers to build custom networks, known as subnets, that can work together smoothly. With Avalanche, there's exciting potential for new applications in finance, gaming, and beyond!

How Does Avalanche Work?

Avalanche's design focuses on combining speed, security, and scalability to deliver a powerful blockchain experience. Avalanche is built on three main blockchains, each with a specific role that enhances the ecosystem’s efficiency and flexibility: the X-Chain, C-Chain, and P-Chain.

| Chain | Function | Key Features |

|---|---|---|

| X-Chain | Focuses on asset exchange and transfer. |

|

| C-Chain | Executes smart contracts. |

|

| P-Chain | Manages network and validator coordination. |

|

How Chains Work Together

- Interoperability: The three chains seamlessly interact. For instance, users can create assets on the X-Chain, use them in smart contracts on the C-Chain, and manage transactions through the P-Chain.

- Asset Transfers: Assets from the X-Chain can easily be transferred to the C-Chain for use in dApps or smart contracts, allowing for smooth movement of assets within the Avalanche ecosystem.

- Subnet Management: The P-Chain is essential for managing subnets that can function independently while still interacting with the X-Chain and C-Chain. This customization enhances scalability while retaining core functionalities.

- Consensus Coordination: The P-Chain coordinates validators across all chains, ensuring efficient consensus without sacrificing security or speed. This coordination is vital for maintaining a cohesive network where all transactions are validated promptly.

What Are Subnetworks in Avalanche?

Subnetworks, or "subnets," are a core innovation in the Avalanche blockchain that allows developers to build custom networks with unique rules and configurations. These subnets enable specialized, scalable solutions for diverse blockchain applications, from gaming to decentralized finance (DeFi). Let’s break down what subnets are, why they matter, and how they’re transforming real-world projects.

Subnetworks Explained: What They Are and Why They Matter

In Avalanche, subnetworks operate as independent blockchains within the broader Avalanche ecosystem. Here’s a simplified look at how subnets work and their major benefits:

- Independent Architecture: Each subnet is like a private mini-blockchain, with its own rules, validators, and structure. This means they don’t compete for resources with the main Avalanche network or other subnets, allowing them to scale more efficiently.

- Customizability: Subnets let developers create tailored blockchain environments. For example, they can specify unique validator requirements, transaction fees, and consensus protocols. Unlike traditional blockchains, where all nodes must follow the same rules, Avalanche subnets offer freedom to design what works best for their purpose.

- Flexible Validator Membership: Subnets allow validators (the entities securing the network) to come and go as needed. Validators stake a minimum of 2,000 AVAX tokens, which helps ensure robust security.

- Interoperability: Subnets can communicate with each other and the main Avalanche network, allowing seamless asset transfers and interactions across chains.

- Scalability: Since each subnet handles its own traffic, it reduces congestion on the main network, leading to faster transactions and lower fees for users.

- Custom Security: Subnets can adjust security measures to meet their needs, creating unique environments that benefit from Avalanche’s powerful consensus mechanism.

- Fast Finality: With Avalanche’s consensus protocol, subnets achieve transaction confirmation quickly, often under a second. This is ideal for applications needing high-speed processing.

Subnetworks in Action: Real-World Examples

Let’s look at some projects using Avalanche’s subnets to solve real-world problems and improve user experience.

DeFi Kingdoms (DFK Chain)

Project Overview: DeFi Kingdoms is a fantasy-based play-to-earn game where players can stake, farm, and trade assets.

- Problem: The game wanted to onboard new users smoothly, but newcomers found it complicated to purchase tokens due to a lack of easy fiat (cash) on-ramps.

- Solution: By moving to the DFK Chain (a dedicated Avalanche subnet), DeFi Kingdoms could simplify its onboarding. The game introduced a Token Checkout feature, allowing players to buy tokens with credit or debit cards directly within the game. This straightforward process made it much easier for beginners to get started, driving up user engagement and transaction volumes.

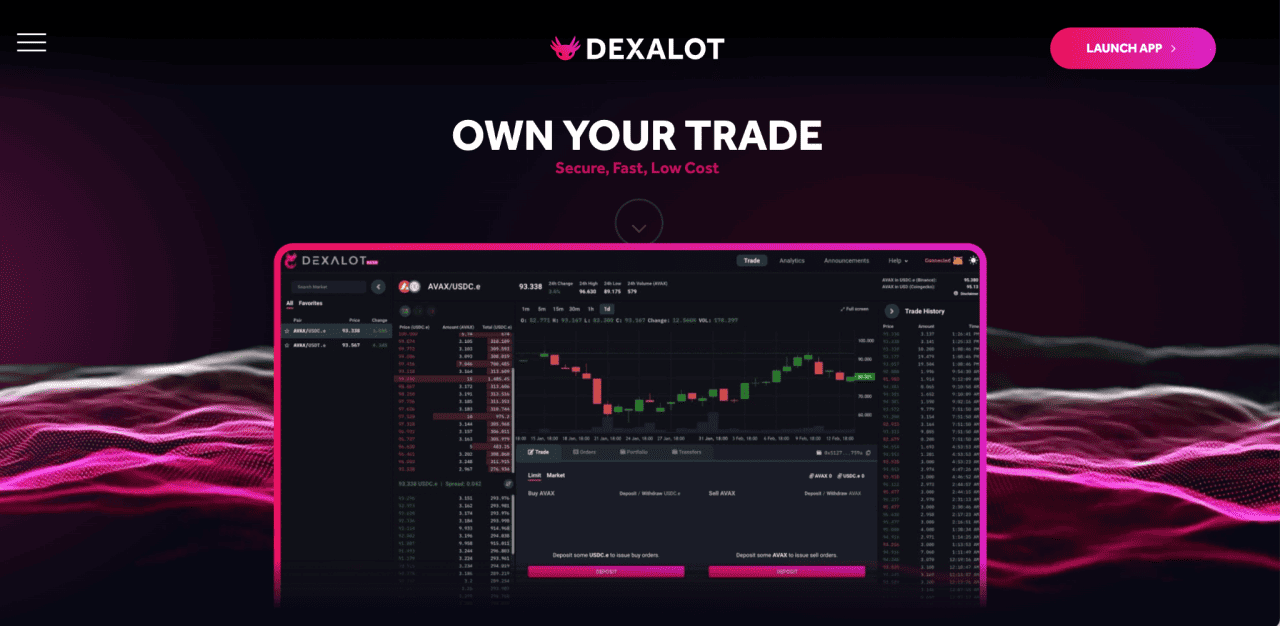

Dexalot

Project Overview: Dexalot is a decentralized exchange (DEX) designed to feel like a centralized exchange, providing high-speed trading with decentralized security.

- Problem: Traditional DEXs often face liquidity and speed issues, leading to a clunky user experience that deters traders.

- Solution: Leveraging an Avalanche subnet, Dexalot provides faster, cheaper transactions and ensures strong liquidity pools. By enhancing speed and reducing fees, Dexalot delivers a seamless trading experience, which attracts more users compared to standard DEX platforms.

Shrapnel

Project Overview: Shrapnel is a first-person shooter game where players truly own their in-game assets, thanks to blockchain technology.

- Problem: Most gaming platforms don’t provide true asset ownership. Players may spend money on items they can’t freely trade or take out of the game, which limits their value.

- Solution: Shrapnel uses an Avalanche subnet to turn in-game items into NFTs, so players fully own their assets and can trade them outside the game. This model boosts player engagement and gives items real-world value, creating a vibrant secondary market for these digital assets.

Avalanche subnets allow projects to design custom blockchains with speed, flexibility, and security that match their unique needs. By reducing network congestion, providing fast transaction finality, and enabling true ownership of assets, subnets are helping projects like DeFi Kingdoms, Dexalot, and Shrapnel reach new heights in user engagement and functionality.

How Avalanche (AVAX) Gains Value: Simplified Tokenomics Explained

Avalanche (AVAX) operates with a thoughtful tokenomics model designed to support its ecosystem's growth, value, and functionality. Here’s a breakdown of the key components that drive AVAX’s value—featuring supply dynamics, staking, and governance—along with relatable examples to make these concepts clearer.

Supply Dynamics: Creating Scarcity and Value

- Fixed Supply: Avalanche has a total cap of 720 million AVAX tokens, setting a limit that creates scarcity—similar to how rare items, like limited-edition collectibles, gain value because they're in short supply. Currently, around 406 million AVAX tokens are circulating, with more than 50% of the total supply already out in the market.

- Token Distribution: When AVAX launched in 2020, tokens were allocated strategically:

- 10% went to the Avalanche team to support continued development.

- 9.26% was allocated to the Avalanche Foundation to foster ecosystem growth.

- 5% went to strategic partners, much like giving shares to early investors to build credibility and long-term alliances.

- Burn Mechanism: A unique feature of Avalanche’s model is that every AVAX used for transaction fees is permanently burned (or removed from circulation). Think of it like having a restaurant that shreds each dollar bill customers pay with, limiting the cash available and adding value to each remaining bill. This deflationary process counteracts the new tokens entering circulation, helping to sustain AVAX's value over time.

Staking Process: Earning Rewards by Securing the Network

- Proof-of-Stake (PoS): Avalanche uses PoS, allowing AVAX holders to "stake" their tokens to secure the network. This process is like voting for local government; participants earn rewards for their contributions and help maintain order. AVAX holders can run their own validator nodes or delegate their tokens to other validators if they don’t meet the 2,000 AVAX minimum requirement. Delegation, available for as little as 25 AVAX, allows more users to participate without needing a large stake.

- Staking Rewards: Stakers currently earn around 9% annually, a rate similar to interest on a savings account but with the added bonus of helping secure a blockchain. Currently, about 65% of the circulating supply is staked, reflecting high user trust in AVAX’s system.

- Dynamic Emission Schedule: Instead of a fixed interest, new AVAX tokens are gradually minted for validators and delegators, with a decreasing issuance rate over time. This approach rewards early supporters while ensuring a sustainable supply for the future.

Governance Mechanisms: Shaping the Network Together

- Decentralized Governance: AVAX is both a utility and governance token, granting holders a say in important network decisions. It’s similar to being a shareholder in a company, where token holders can vote on proposals and changes to improve the network.

- Proposal System: Anyone can propose upgrades or adjustments to Avalanche’s structure, much like a suggestion box at work where everyone’s input is valued. This allows the network to remain adaptable and responsive to community needs and market changes.

Case Study: Market Trends and Price History of AVAX

Since its 2020 launch, AVAX has been through highs and lows, shaped by both its internal tokenomics and external market conditions:

- Initial Hype and Launch: When Avalanche launched, it quickly attracted attention for its high transaction speed and scalability. Imagine a new tech product launch that everyone wants to try; this hype pushed AVAX’s price to an all-time high of around $144.96 in November 2021.

- Market Volatility: Like many assets, AVAX’s price follows broader market trends. For instance, during 2022’s bearish market, its price dropped to around $8.90—a reflection of how crypto values can ebb and flow with market sentiment and global economic conditions.

- Supply Dynamics Impact: As more tokens became unlocked (worth about $3.5 billion), additional supply created selling pressure. This situation is similar to flooding a market with a product, where too much availability can impact price stability even in a thriving market.

- Consolidation Phases: After high volatility, AVAX often consolidates, with prices stabilizing within a range. This phase is like the calm after a storm, where the price finds balance as the market absorbs recent changes.

- Growing Adoption and Partnerships: As more projects and decentralized applications (dApps) launch on Avalanche, demand for AVAX increases. For example, partnerships with platforms like SushiSwap boost visibility and credibility, much like a new app gaining traction from partnerships with popular tech brands.

Avalanche in DeFi: High-Speed, Low-Cost Transactions for Everyone

Avalanche has rapidly become a go-to blockchain for decentralized finance (DeFi) projects, due to its high throughput, low transaction fees, and quick finality. Think of Avalanche as a "superhighway" for transactions: while some blockchains experience traffic jams and costly tolls, Avalanche offers a smooth and affordable route. Here’s how top DeFi platforms are leveraging this network:

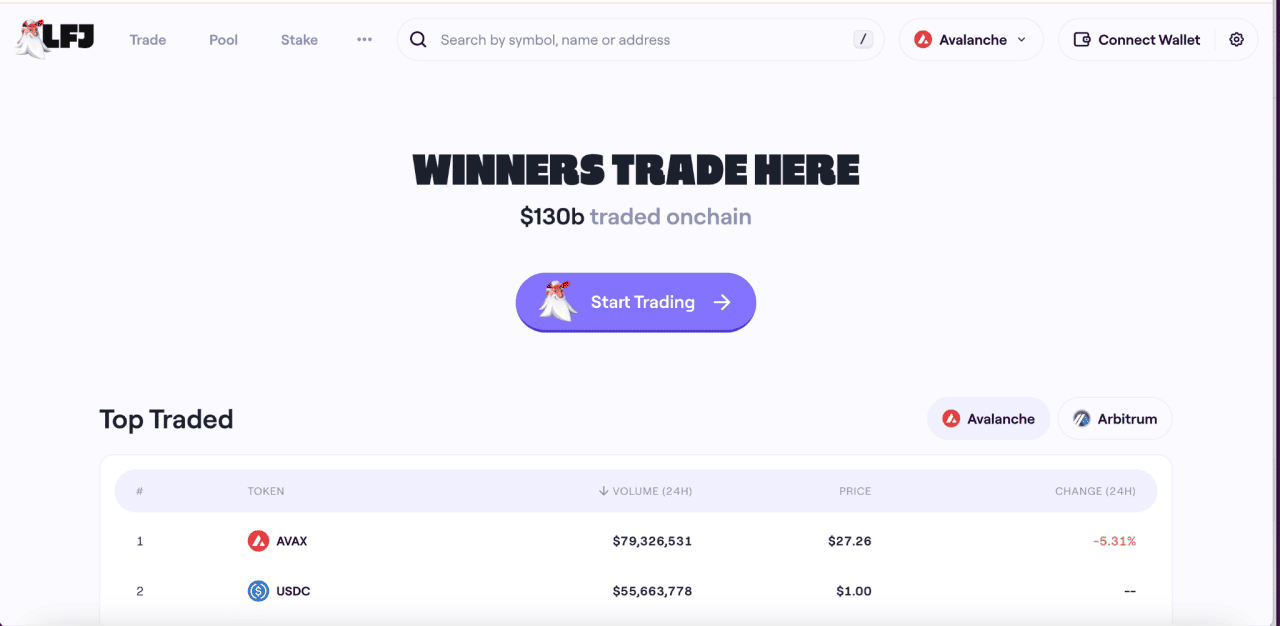

1. Trader Joe

- Overview: Trader Joe is like a virtual bank and stock exchange combined, where users can trade tokens, earn yield, and provide liquidity. With over $130 million in total value locked (TVL), Trader Joe is a key player in Avalanche’s DeFi ecosystem.

- Key Features: Trader Joe enables fast transactions and substantial fee generation, ranking among top DeFi apps for its fee income.

- Impact: By providing reliable liquidity and an easy-to-navigate platform, Trader Joe acts as a major entry point for both new and experienced DeFi users. Just as a bustling shopping mall attracts various vendors, Trader Joe’s success brings more liquidity and activity into the Avalanche network.

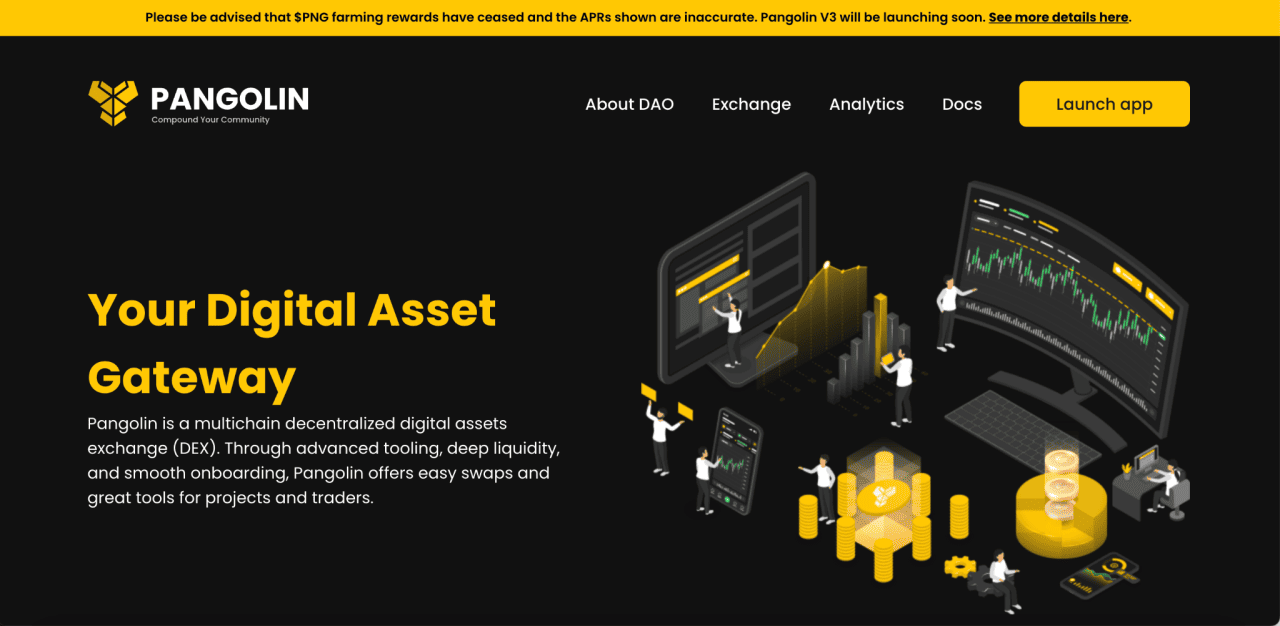

2. Pangolin

- Overview: Like a farmer’s market, Pangolin allows users to swap tokens with low fees and little delay, offering a community-centered approach to decentralized trading.

- Key Features: Pangolin uses community-driven governance, meaning token holders can vote on key decisions. It offers a variety of liquidity pools, ensuring users get fair prices.

- Impact: Pangolin’s low fees attract users who seek alternatives to high-cost Ethereum transactions. By creating a vibrant community and fair trading environment, Pangolin pulls users from multiple ecosystems, adding diversity and growth to Avalanche’s DeFi landscape.

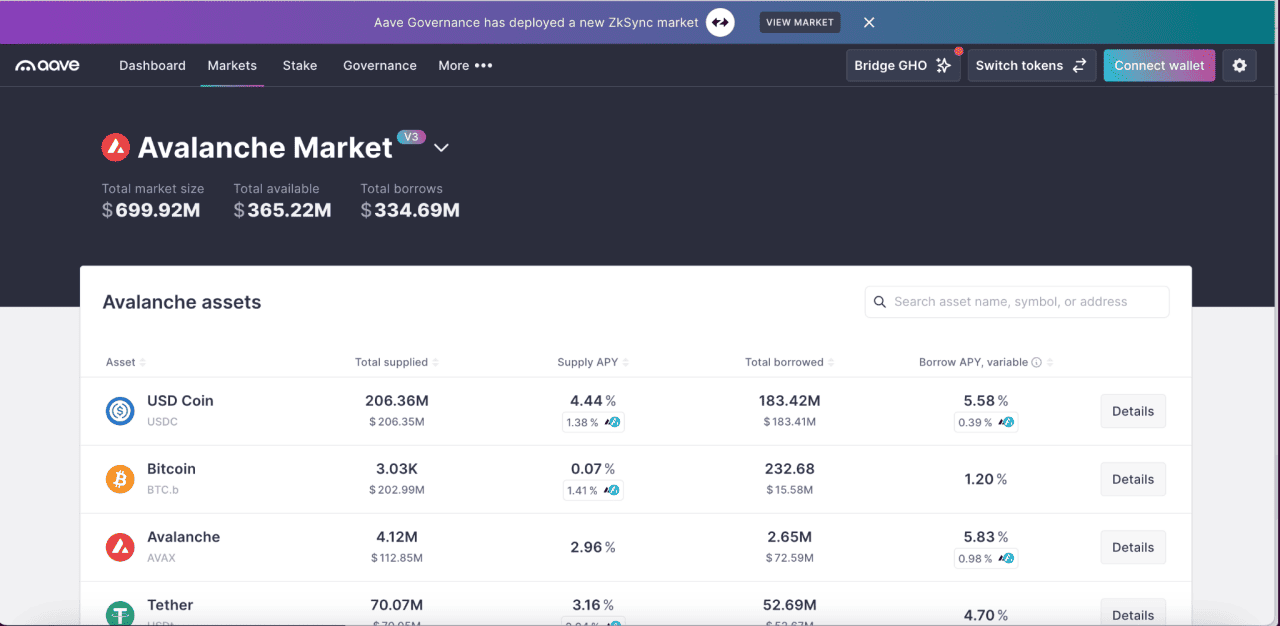

3. Aave

- Overview: Aave is a popular DeFi lending platform that recently expanded to Avalanche. Think of it as a decentralized “lending library” where users can borrow and lend assets without middlemen.

- Key Features: By leveraging Avalanche’s speed and low fees, Aave provides users with a more cost-effective alternative compared to its Ethereum-based counterpart.

- Impact: Aave’s move to Avalanche enhances its accessibility, allowing more users to engage in lending and borrowing at lower costs. This partnership also signals Avalanche’s growing prominence, as established DeFi platforms choose it for expansion.

Avalanche in NFTs: Speed, Affordability, and Cross-Chain Compatibility

Avalanche has emerged as a strong foundation for NFTs (non-fungible tokens), offering fast transactions and low fees that make it easy for creators to mint, trade, and showcase their work. Think of Avalanche as a virtual gallery with affordable entry fees, drawing artists, collectors, and gaming projects alike.

Avaissance Initiative

- Overview: Avaissance is Avalanche’s art-support program, like a talent incubator for NFT artists. Through the Artist-in-Residence (AIR) program and the Mona Lisa Initiative (MLI), Avalanche funds and promotes digital artists, fostering creativity in the NFT sector.

- Impact: Just as art galleries sponsor new artists, Avaissance helps artists showcase their work without worrying about high minting fees. This initiative strengthens Avalanche’s position as a hub for digital art, where creators can thrive without the financial burden seen on other platforms.

Low Fees and Fast Transactions

- Example: Imagine an artist selling limited-edition digital prints. On Avalanche, they avoid the high gas fees of other blockchains, making it easier and more affordable for both the artist and buyers to transact. With an average finality of 0.79 seconds, transactions are almost instant—perfect for competitive, time-sensitive sales and auctions.

Interoperability with Avalanche Bridge

- Overview: Avalanche's compatibility with other chains, like Ethereum, allows users to transfer NFTs easily between networks. This feature is similar to an international art fair where artists can display works to audiences from different regions, expanding their reach and potential market.

- Impact: The Avalanche Bridge enhances liquidity and accessibility, enabling NFT creators and collectors to interact with broader markets beyond Avalanche’s native ecosystem.

Avalanche in Gaming: Fast and Scalable for High-Interaction Environments

Avalanche is also gaining popularity in gaming, where its speed and scalability are ideal for high-volume, interactive applications. In gaming terms, Avalanche functions like a powerful game server that can handle intense action without lag, making it an attractive option for developers looking to build next-gen blockchain games.

Benqi

- Overview: Benqi is a DeFi platform that incorporates gaming elements, rewarding users as they engage in activities like lending and borrowing. It’s like a gamified financial platform where users “level up” as they earn interest.

- Impact: Benqi uses Avalanche’s low fees and speed to keep the platform engaging, attracting users who enjoy both financial growth and interactive gaming elements, increasing user retention.

Yield Yak

- Overview: Yield Yak is a yield aggregator on Avalanche, helping users optimize returns by automatically reallocating funds across various liquidity pools. Think of it as an autopilot for DeFi investments, taking advantage of Avalanche’s fast transactions.

- Impact: Yield Yak enables users to maximize their profits without constant manual effort, adding to Avalanche’s DeFi value proposition and making it easy for users to stay active on the platform.

Conclusion

Avalanche (AVAX) isn’t just another blockchain; it’s a robust, scalable ecosystem reshaping how we approach DeFi, NFTs, and gaming. Its high-speed, low-cost structure and seamless interoperability make it a compelling choice for creators, investors, and users seeking next-generation blockchain solutions. With a strong foundation in its unique tokenomics, governance, and subnetwork capabilities, Avalanche is positioned to drive widespread blockchain adoption and innovation for years to come.

Frequently Asked Questions About Avalanche (AVAX)

How does Avalanche handle scalability challenges?

Avalanche uses a unique architecture with three chains (X-Chain, C-Chain, P-Chain) and customizable subnets to reduce congestion and distribute transactions efficiently, enabling high throughput and fast transaction finality.

What are the environmental impacts of Avalanche?

Avalanche’s Proof-of-Stake (PoS) model is energy-efficient, minimizing its carbon footprint by requiring token staking instead of energy-intensive mining, making it more sustainable than older Proof-of-Work systems.

How does community governance work in Avalanche?

AVAX holders participate in governance by voting on proposals related to network upgrades and changes, allowing for decentralized decision-making and active community involvement.

What types of projects are best suited for Avalanche?

Avalanche is well-suited for a variety of projects, particularly those that require high-speed, low-cost transactions and flexible scalability. Here are the types of projects that thrive on the Avalanche network:

- Decentralized Finance (DeFi) Platforms

Avalanche’s low fees and rapid transaction processing are ideal for DeFi applications, where users need to make fast and affordable trades, lend and borrow assets, and manage liquidity pools. - Non-Fungible Token (NFT) Marketplaces and Digital Art

The Avalanche network’s affordability and near-instant transaction finality make it a strong candidate for NFT marketplaces and digital art projects. Its low gas fees allow creators to mint and trade NFTs without high overhead costs, which is crucial in attracting artists and buyers. - Gaming Applications

Avalanche’s scalability and fast processing make it a great fit for blockchain gaming, where high interaction speeds are crucial. Gaming applications, especially those with integrated economies or play-to-earn models, need to handle a large number of transactions without lags. - Enterprise Applications and Private Blockchains

Avalanche's subnetworks allow enterprises to create private or permissioned chains with customizable settings. - Cross-Chain Bridges and Interoperability Solutions

Avalanche is also ideal for projects aiming to bridge multiple blockchain ecosystems.