Introduction

In today’s fast-paced financial markets, AI trading bots have become indispensable tools, enabling both novice and seasoned traders to stay ahead with automated, data-driven trades.

These bots harness sophisticated algorithms to analyze vast amounts of market data, making decisions in real-time, 24/7, and offering unique advantages that are nearly impossible to achieve through manual trading alone. But with a plethora of options available, how do you choose the best bot that aligns with your trading goals, risk tolerance, and strategy preferences?

This comprehensive guide will walk you through everything you need to know about AI trading bots—from their must-have features and benefits to the key considerations when selecting the right one.

We’ll also introduce the Top 6 AI trading bots of 2024, tailored to various trading styles and levels of experience. Whether you're new to trading or a seasoned investor, this guide will equip you with the knowledge to make informed decisions and avoid common pitfalls along the way.

What is an AI Trading Bot?

An AI trading bot is an advanced software tool that harnesses artificial intelligence to automate trading in financial markets, particularly in the fast-paced realms of cryptocurrencies and stocks. Think of it as your digital trading assistant—always on, always analyzing. These bots evaluate market trends, monitor real-time prices, and execute trades on your behalf, following the specific rules you set.

Key Features of AI Trading Bots

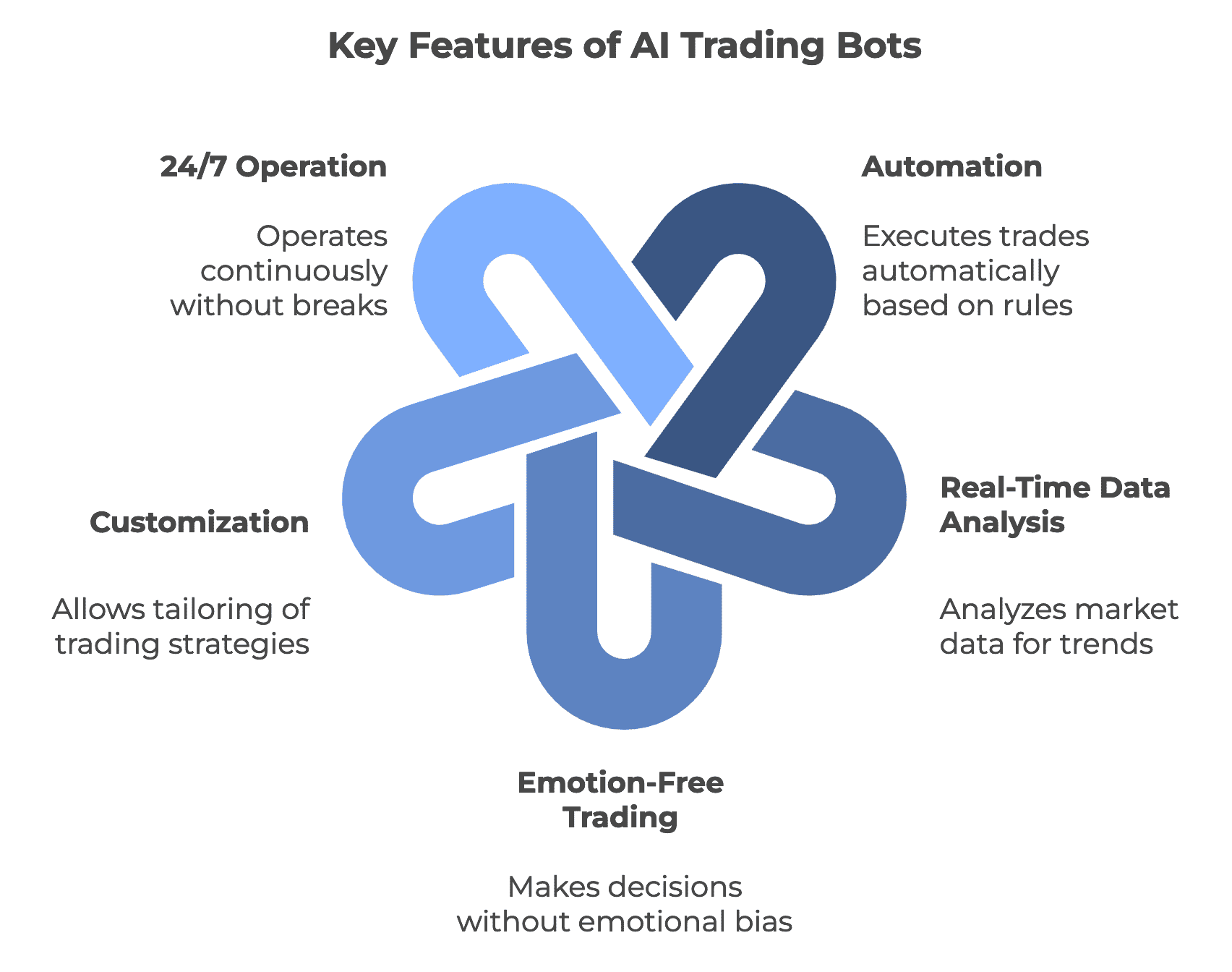

- Automation: AI trading bots execute trades automatically based on pre-defined rules, allowing them to buy or sell assets without any human intervention, saving you time and effort.

- Real-Time Data Analysis: These bots analyze vast amounts of market data, pinpointing trends and potential trading opportunities at lightning speed, ensuring you never miss a chance to profit.

- Emotion-Free Trading: Unlike human traders, AI bots are immune to emotions like fear and greed. This objectivity enables them to adhere strictly to their strategies, making rational decisions even in volatile markets.

- Customization: Many bots allow users to tailor their trading strategies according to their risk tolerance and investment goals, making them suitable for traders of all experience levels—from beginners to seasoned professionals.

- 24/7 Operation: AI trading bots operate around the clock, continuously monitoring the market and executing trades, even while you’re sleeping or busy with other activities. This means your investment opportunities never sleep!

Benefits of AI Trading Bots

AI trading bots are invaluable for saving time and automating trades. By continuously monitoring market conditions and executing orders based on real-time data analysis, these bots enable traders of all levels to focus on developing effective strategies rather than getting bogged down with manual execution. Here are some key benefits:

Round-the-Clock Monitoring

Operating 24/7, AI trading bots ensure that trades are executed at the best possible times without constant human oversight. This means you'll never miss out on potential opportunities, even when you're not glued to your screen.

Advanced Pattern Recognition

Using sophisticated algorithms, these bots identify trends and patterns in market data, making swift, data-driven decisions. This ability to detect subtle market shifts helps traders respond faster than they could manually.

Scalability and Diversification

For seasoned traders, AI trading bots can manage multiple trades across different exchanges simultaneously. This scalability enables traders to diversify their portfolios and seize opportunities across various markets while keeping their strategies streamlined.

Potential Risks of AI Trading Bots

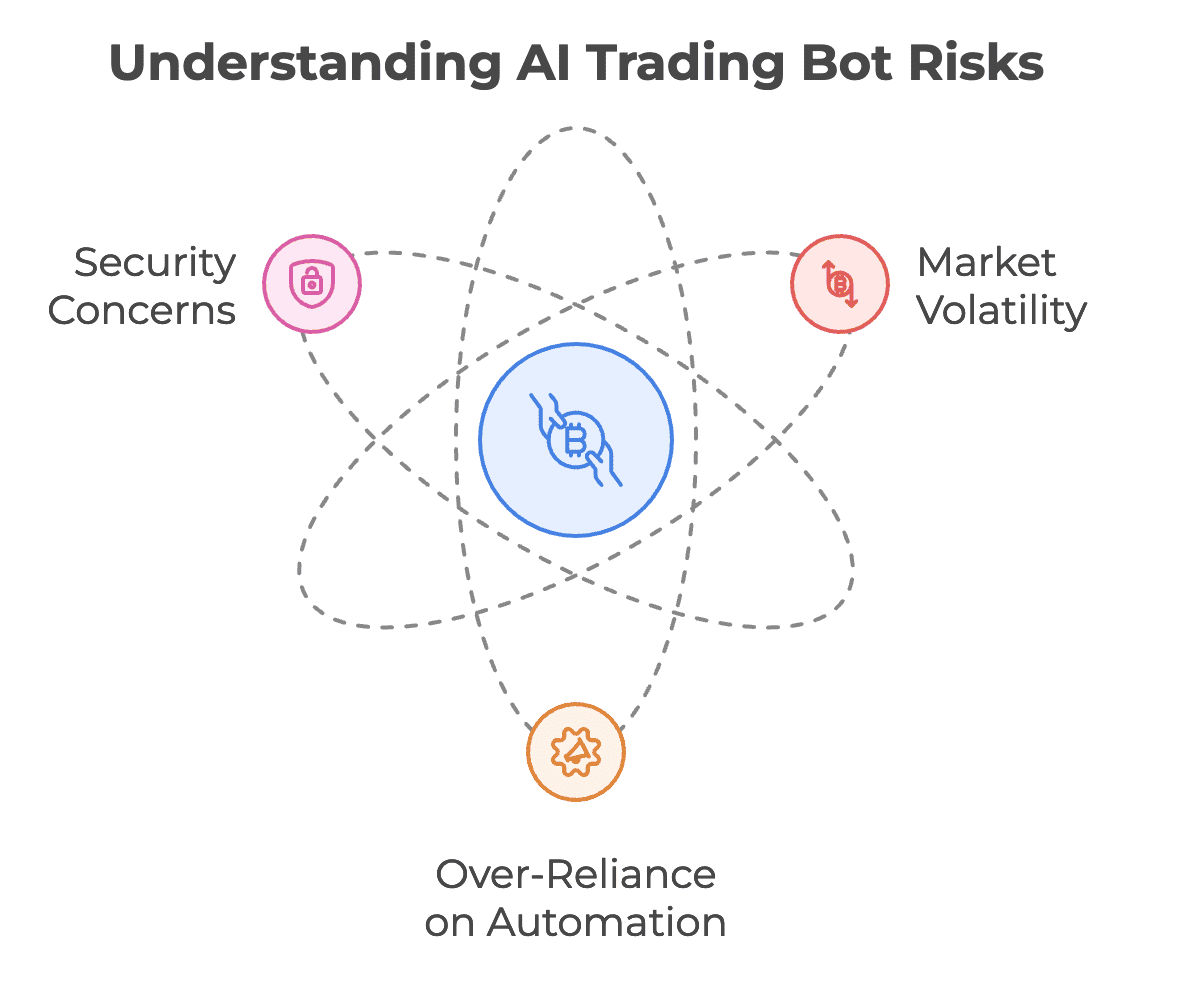

While AI trading bots offer numerous benefits, traders should be aware of several potential risks, particularly concerning market volatility, over-reliance on automation, and security concerns.

Market Volatility

The cryptocurrency market is notorious for its volatility, with prices capable of swinging dramatically in short timeframes. While AI trading bots are designed to respond to these changes, they may not always adapt perfectly to extreme market conditions or unexpected events. This can lead to potential losses if their algorithms fail to react swiftly to sudden price movements.

Over-Reliance on Automation

Becoming overly reliant on trading bots can be risky. Traders might disengage from the market, missing crucial signals or shifts in overall sentiment. Additionally, if a bot’s strategy isn’t regularly updated or monitored, it could lose effectiveness over time, especially as market dynamics shift.

Security Concerns

Since AI trading bots require access to trading accounts via API keys, there’s always a risk of security breaches. If a bot’s connection is compromised, hackers could potentially access a trader’s funds or manipulate trades. Therefore, using bots with robust security features and implementing additional measures, such as two-factor authentication (2FA), is paramount.

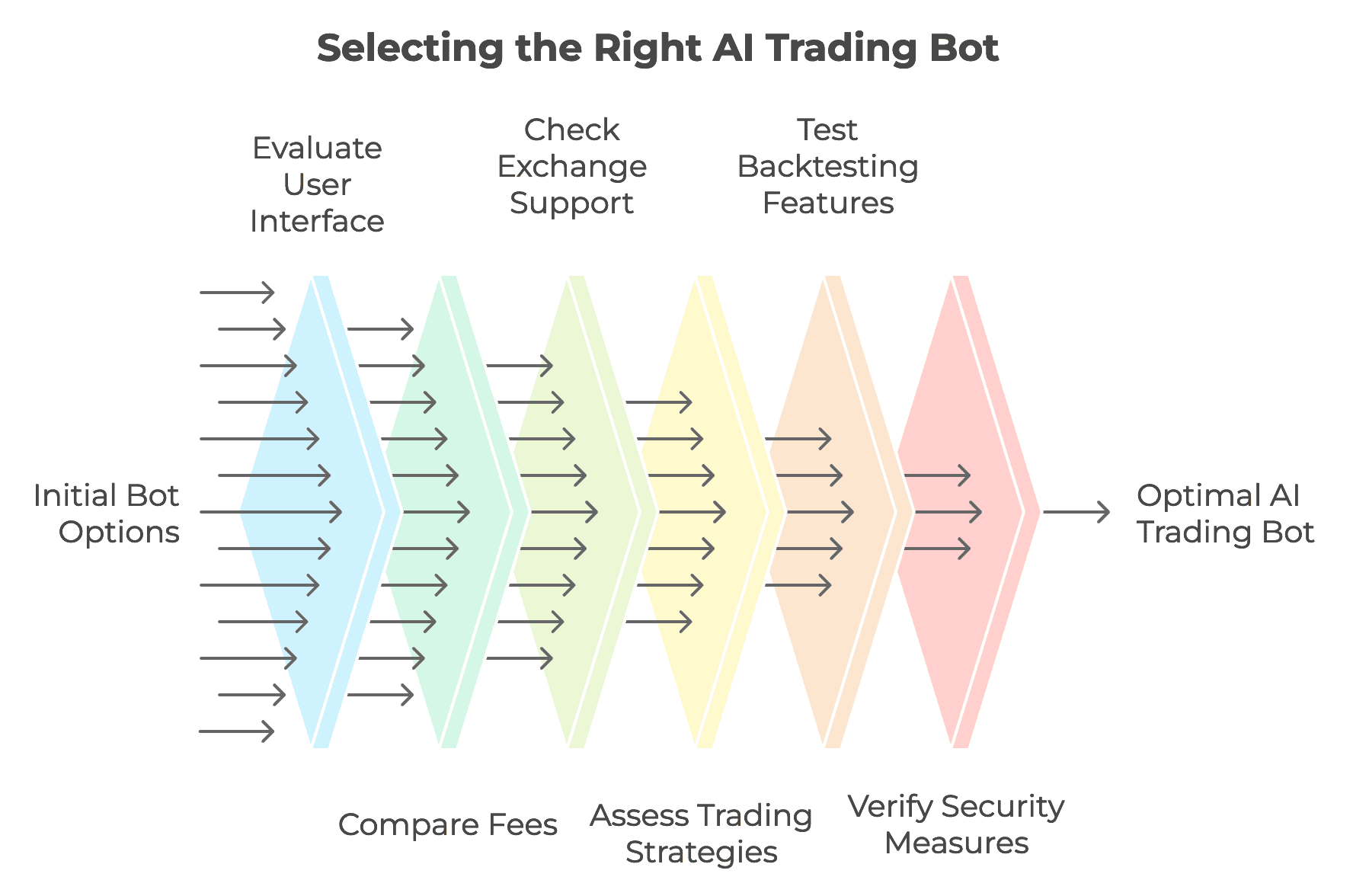

How to Choose the Right AI Trading Bot?

Selecting the right AI trading bot is crucial for achieving your trading goals. Here’s a practical guide to help you choose the best tool for your needs. Here are some essential factors to consider:

1. User Interface and Ease of Use

Look for a bot with a clear dashboard that offers tutorials or demo modes for beginners. Consider using a bot with drag-and-drop features for strategy building, and ensure it has a mobile app for on-the-go monitoring.

2. Fees

Create a spreadsheet to compare the fee structures of different bots. Include subscription fees, transaction fees, and any other hidden costs. Calculate potential impacts on profitability based on your trading volume and frequency.

3. Supported Exchanges

List your preferred exchanges and verify that the bot supports them. Read user reviews or the bot’s documentation to ensure seamless integration and stable performance with these exchanges.

4. Trading Strategies Supported

Identify your trading style (e.g., day trading, swing trading, or long-term holding) and check if the bot provides customizable strategies that fit this style. Look for bots that allow for strategy tweaking to adapt to market conditions.

5. Backtesting Features

Choose a bot that allows you to backtest strategies using historical data. Start by testing with a small amount of capital to evaluate the effectiveness of the strategy before scaling up. Use backtesting to refine entry and exit points based on past performance.

6. Risk Management Tools

Ensure the bot offers comprehensive risk management features. Look for:

- Stop-Loss Orders: Set automated sell orders to limit losses on trades.

- Portfolio Rebalancing: Regularly adjust your portfolio to maintain desired risk levels.

- Automated Risk Assessments: Use bots that analyze market conditions and adjust positions accordingly.

7. Security Measures

Prioritize bots that offer:

- Encryption: Ensure all sensitive data is encrypted during transmission.

- Two-Factor Authentication (2FA): Activate 2FA to add an extra layer of security to your account.

- Secure API Connections: Use bots that require API keys with limited permissions to minimize risk.

Practical Tips for Selection

- Start with a Trial: If possible, use a free trial or demo account to test the bot's functionality and support before committing.

- Community and Support: Check if there’s an active user community or customer support available. Engage with the community for insights and tips.

- Consider Your Trading Goals: Align your bot selection with your long-term investment objectives and risk tolerance.

- Stay Updated: Keep abreast of the latest advancements in AI trading technology and consider upgrading your bot as needed.

Top 6 AI Trading Bots for Every Trader in 2024

| Feature | Target User | Key Features | Pros | Cons |

|---|---|---|---|---|

| Botsfolio | Beginners | Pre-made portfolios, no coding, easy integration | User-friendly, affordable | Limited exchanges, basic features |

| 3Commas | Experienced Traders | Customizable strategies, multiple exchange support | Customizable, multiple exchanges | Complex, subscription-based |

| Themis | Automated Strategies | Backtesting, AI trading tools, zero-risk guarantee | Automated trading, in-depth analysis | Potential bugs, limited human intuition |

| WunderBit | Copy Trading | Copy trading, TradingView integration | Easy to follow experts, learn from pros | Reliant on others' strategies, performance depends on the trader |

| Pionex | Free Trading | Multiple free bots, user-friendly | Free to use, diverse strategies | Limited advanced features |

| Growlonix | Security-Focused | Advanced security protocols, 2FA | Secure, reliable | Steeper learning curve, may be less user-friendly |

Best for Beginners: Botsfolio

Botsfolio is a fantastic option for beginners looking to trade cryptocurrencies without the complexity of coding or advanced strategies. It offers pre-made portfolios tailored to various risk profiles and investment goals, making it simple for anyone to start investing in crypto with confidence.

Key Features:

- No Coding Required: Users can set up their trading strategies without any programming knowledge.

- Investment Goal Selection: Traders can choose from predefined investment goals tailored to their risk tolerance and objectives.

- Easy Integration: Currently supports Binance, making it straightforward for users to connect their accounts and start trading.

- Fully Automated Portfolio Management: The bot manages trades automatically based on user-defined parameters.

| Pros | Cons |

|---|---|

|

|

Best for Experienced Traders: 3Commas

3Commas is a platform for traders seeking advanced, code-free AI crypto trading bots like Dollar-Cost Averaging (DCA), GRID, and Signal Bot with TradingView integration. It centralizes crypto asset management across multiple exchanges, offering tools for trade execution, portfolio analysis, and access to spot, margin, and options markets, all aimed at enhancing trading efficiency.

Key Features:

- Smart Trading Terminal: Allows users to manage multiple trades efficiently.

- Portfolio Management Tools: Helps track investments across different platforms.

- Customizable Trading Strategies: Supports grid trading, dollar-cost averaging, and more.

| Pros | Cons |

|---|---|

|

|

Best for Automated Strategies: Themis

Themis is designed for traders aiming to automate their strategies efficiently. It uses advanced algorithms for backtesting and optimizing, helping users execute trades based on historical data. Themis also offers AI trading tools that let clients create custom trading bots—simply by interacting with the system. This feature enables users to have a personal trading assistant that operates 24/7 across crypto, stock, and forex markets.

Key Features:

- Backtesting Capabilities: Tests strategies against historical data to evaluate their effectiveness.

- Zero-Risk Guarantee: For trades under $100, if the trade goes bad, users don't lose money.

- User-Friendly Interface: Easy setup and operation, suitable for traders of all experience levels.

| Pros | Cons |

|---|---|

|

|

Best for Copy Trading: WunderBit

WunderBit focuses on social trading, making it easy for users to follow and copy the trades of experienced investors. This feature is perfect for beginners who want to learn from the pros while potentially boosting their success. The platform also offers tools to turn any TradingView script into an automated bot, allowing you to quickly create and tweak your trading strategies in a user-friendly, cloud-based environment.

Key Features:

- Copy Trading Functionality: Users can replicate the trades of top-performing traders automatically.

- Diverse Asset Support: Offers various cryptocurrencies and trading pairs for copying.

| Pros | Cons |

|---|---|

|

|

Best Free Trading Bot: Pionex

Pionex is a unique platform that offers free trading bots, making it an attractive option for traders who want to dive into automated trading without any subscription costs. It provides various trading bots to help you trade popular cryptocurrencies like Bitcoin, Ethereum, and Dogecoin securely and automatically. This allows users to start trading with ease and flexibility, even if they are new to the market.

Key Features:

- Multiple Free Bots: Includes various trading bots like grid trading and dollar-cost averaging.

- User-Friendly Interface: Designed for easy navigation and quick setup.

| Pros | Cons |

|---|---|

|

|

Best for Security: Growlonix

Growlonix focuses on security, making it an ideal option for traders concerned about asset protection. The platform employs strong measures to safeguard user data and funds, prioritizing stability and safety in its development. Sensitive data is stored with 256-bit encryption, and two-factor authentication (2FA) adds an extra layer of protection for users.

Key Features:

- Advanced Security Protocols: Utilizes encryption and multi-factor authentication to protect user accounts.

- Secure API Connections: Ensures safe interactions with exchanges.

| Pros | Cons |

|---|---|

|

|

Common Mistakes to Avoid When Using AI Trading Bots

Using AI trading bots can be a game-changer for traders, but it's crucial to avoid common pitfalls that can lead to financial losses. Let’s dive into some key mistakes you should steer clear of to maximize your trading success!

1. Not Setting Realistic Expectations

2. Ignoring Market Volatility

3. Overlooking Fees

4. Choosing the Wrong Exchanges

5. Neglecting Regular Maintenance

6. Over-Leveraging

7. Skipping Backtesting

Conclusion

AI trading bots can revolutionize the way you approach the markets, giving you the speed, precision, and flexibility to capitalize on opportunities around the clock. However, as with any tool, they require thoughtful selection and management to ensure they complement your strategy without exposing you to unnecessary risks. By focusing on your trading objectives, risk tolerance, and the features that align with your trading style, you can make the most of these powerful bots.

Remember, the best AI trading bot is one that evolves with your needs and adapts to the dynamic nature of the markets. Follow the guidelines outlined in this guide, leverage the power of automation, and stay vigilant to maximize your success in the trading world.

FAQs About AI Trading Bots

Are AI trading bots legal to use?

Yes, AI trading bots are generally legal in most jurisdictions, including the U.S. They help automate trading strategies but must be used in compliance with laws against market manipulation and insider trading. Traders should stay informed about relevant regulations to avoid penalties.

Can I customize my trading strategies with a bot?

Yes, many AI trading bots allow for extensive customization. Traders can set parameters like risk tolerance, asset selection, and trading frequency. This flexibility helps users implement strategies that align with their investment goals and test them through backtesting features.

What are the risks associated with using AI trading bots?

AI trading bots come with risks such as market volatility, which can lead to unexpected losses if not managed properly. Over-reliance on bots may cause traders to neglect market analysis. Additionally, security risks exist, including potential hacks, and not all bots are reputable, so caution is essential.