Introduction

In the fast-paced world of cryptocurrency, choosing the right wallet is critical for securing your digital assets. Whether you’re a newbie just getting started or an experienced investor or DeFi enthusiast, understanding the different types of crypto wallets, their benefits, and security features is essential for navigating the digital finance landscape.

From hot wallets for daily transactions to cold wallets for long-term storage, and even multi-signature and AI-powered wallets for enhanced security, the options are diverse. But with this variety comes potential pitfalls and hidden misconceptions that can put your funds at risk.

In this guide, we’ll break down the essential types of wallets, provide key insights into selecting the right one for your needs, and share best practices for keeping your wallet safe in 2024.

What is a Crypto Wallet?

A crypto wallet is your digital vault, designed to store the private keys that control your cryptocurrencies. These keys allow you to send, receive, and manage your funds securely on the blockchain. Many wallets offer backup and recovery options, so even if you lose your keys, you can still regain access to your assets.

The rise of self-custody is transforming the way people handle their digital wealth, giving users complete control without relying on banks or exchanges. With the growing need for security and privacy, choosing the right wallet has never been more important. It’s your first line of defense against threats and a key part of managing your financial future in the world of DeFi and cryptocurrency.

Understanding Different Types of Crypto Wallets

When choosing a crypto wallet, it's essential to consider your needs and preferences. Here are the main types of wallets available, from hot to multi-signature ones, each with its unique features and benefits to help you securely manage your digital assets.

Hot Wallets

Hot wallets are like your everyday wallet for digital currencies, designed for convenience and ease of use. These wallets are always connected to the internet, allowing you to send and receive cryptocurrencies with just a few taps on your phone.

| Advantages | Disadvantages |

|---|---|

| Convenience: Quick access for daily transactions. | Security Risks: Vulnerable to hacking and phishing. |

| User-Friendly: Intuitive interfaces and mobile apps. | Not Suitable for Long-Term Storage: Not ideal for holding large amounts of cryptocurrency. |

| Ideal for Frequent Transactions: Great for traders and regular purchases. | Higher Risk of Unauthorized Access: Always online, increasing exposure to cyber threats. |

Advantages

Hot wallets shine in their convenience; they provide quick access to your funds, making them perfect for daily transactions. With intuitive interfaces and mobile applications, they cater to users who frequently buy, sell, or trade digital assets. This user-friendly design simplifies the process, allowing even novice users to navigate the world of cryptocurrency effortlessly.

Disadvantages

However, this convenience comes with significant risks. Hot wallets are vulnerable to cyber threats such as hacking and phishing, as their constant online connectivity exposes them to potential attacks. Additionally, while they are excellent for short-term transactions, they are not recommended for storing large amounts of cryptocurrency over an extended period due to the higher risk of unauthorized access.

Cold Wallets

Cold wallets serve as a secure fortress for your cryptocurrency by keeping private keys offline. This approach shields your digital assets from the myriad of online threats, making them an excellent choice for long-term storage.

| Advantages | Disadvantages |

|---|---|

| Enhanced Security: Immune to online hacking attempts. | Less Convenient for Daily Transactions: Requires physical access for transactions. |

| Physical Security: Often tamper-resistant (e.g., hardware wallets). | Potential Loss Risk: If the device is damaged or misplaced, access can be lost. |

| Ideal for Long-Term Storage: Best for holding larger amounts of cryptocurrency. | Complexity in Setup: May require technical knowledge to set up and manage. |

Advantages

The primary advantage of cold wallets is their enhanced security; because they are not connected to the internet, they are largely immune to online hacking attempts and cyber threats. They come in various forms, such as hardware wallets or paper wallets, providing a reliable solution for users looking to safeguard significant amounts of cryptocurrency over time. Additionally, many cold wallets are designed to be tamper-resistant, giving users peace of mind about the physical security of their assets.

Disadvantages

On the flip side, cold wallets can be less convenient for daily transactions. Accessing funds requires physical interaction with the device, which may not be suitable for users who need to make frequent trades. Furthermore, if a cold wallet device is lost, damaged, or misplaced, users risk losing access to their assets entirely. Setting up and managing these wallets can also be complex, potentially intimidating novice users who are less tech-savvy.

Custodial Vs. Non-custodial

Custodial wallets are managed by third-party services that hold your private keys on your behalf, while non-custodial wallets allow users to manage their own private keys directly, giving them full control over their assets.

| Custodial | Non-custodial |

|---|---|

| Managed by Third Parties: Providers hold your private keys. | User Control: You manage your own private keys directly. |

| Simplified User Experience: Good for beginners; often includes support features. | Increased Security: Reduces reliance on third parties. |

| Trust Required: Risk of losing access if the service is hacked or goes bankrupt. | Risk of Loss: If you lose your keys or seed phrase, you may permanently lose access to your funds. |

Custodial

Custodial wallets are managed by third-party services that hold your private keys for you. This makes them user-friendly, especially for beginners, as they often include customer support and easy recovery options. However, since you’re trusting a service to keep your assets safe, there’s a risk: if the service is hacked or has issues, you could lose access to your funds.

Non-custodial

Non-custodial wallets give you full control over your private keys, allowing you to manage your cryptocurrency independently. This means you don’t have to rely on anyone else for security, but it also means you’re responsible for keeping your keys safe. If you lose them, you might lose access to your funds forever. Non-custodial wallets are great for those who want more security and autonomy.

Multi-signature Wallets

Multi-signature (multi-sig) wallets add an extra layer of security by requiring multiple private keys to authorize transactions, making them especially valuable for shared accounts or business settings.

| Advantages | Disadvantages |

|---|---|

| Reduced Risk of Theft or Misuse: Requires consensus from multiple parties before transactions can be executed. | Complex Setup: More complicated than standard wallets; requires coordination among users. |

| Accountability in Shared Accounts: Ideal for businesses or group management of assets. | Slower Transaction Processing: May delay transactions due to the need for multiple approvals. |

Advantages

The key advantage of multi-sig wallets is the enhanced security they provide. By requiring consensus from multiple parties before a transaction can be executed, these wallets significantly reduce the risk of theft or misuse. This feature fosters accountability among users, ensuring that all stakeholders must agree before funds can be moved, which is particularly useful in business scenarios where multiple approvals are necessary.

Disadvantages

However, this added layer of security can also complicate matters. Setting up a multi-signature wallet requires coordination among users, making it more complex than standard wallets. The need for multiple approvals can also slow down transaction processing, which might be inconvenient for users who require quick access to their funds. Despite these challenges, multi-signature wallets remain an excellent choice for those prioritizing security and shared access to assets.

Choosing the Right Wallet for Different Needs

When navigating the world of cryptocurrency, selecting the right wallet is crucial to meet your specific needs, whether for daily transactions, long-term storage, or involvement in decentralized finance (DeFi) and NFTs.

Crypto Wallets for Daily Transactions and Payments

When it comes to daily transactions and payments, certain wallets stand out due to their ease of use, functionality, and user satisfaction. Here are some real-world examples of wallets commonly used for these purposes:

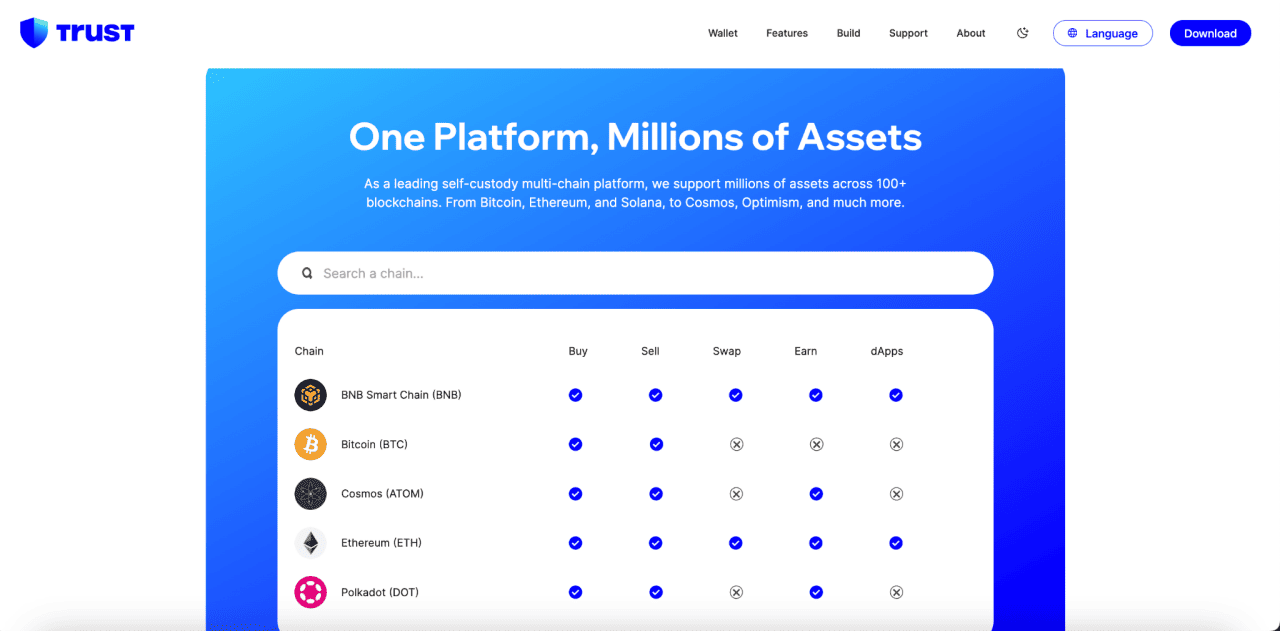

Trust Wallet

It is a user-friendly, multi-chain, self-custody cryptocurrency wallet that allows you to securely store and manage over 10 million crypto assets, including more than 600 million NFTs across 100+ blockchains. As a non-custodial wallet, it gives you full control of your private keys, meaning you are in charge of your funds without relying on third parties.

- Security Features: Trust Wallet offers strong security with biometric access, encrypted private keys, and a 12-word recovery phrase to back up your wallet. It even has a built-in security scanner to warn you about risky transactions.

- Functionality: With Trust Wallet, you can easily send and receive cryptocurrencies, trade NFTs, and access various decentralized applications (dApps). You can also stake over 23 cryptocurrencies to earn rewards.

- Integration Options: The wallet lets you buy cryptocurrencies with debit or credit cards and add custom tokens by entering contract addresses.

- Community and Support: Trust Wallet has a large user community and provides helpful resources for troubleshooting, making it a great choice for both beginners and experienced users looking to explore the crypto world safely.

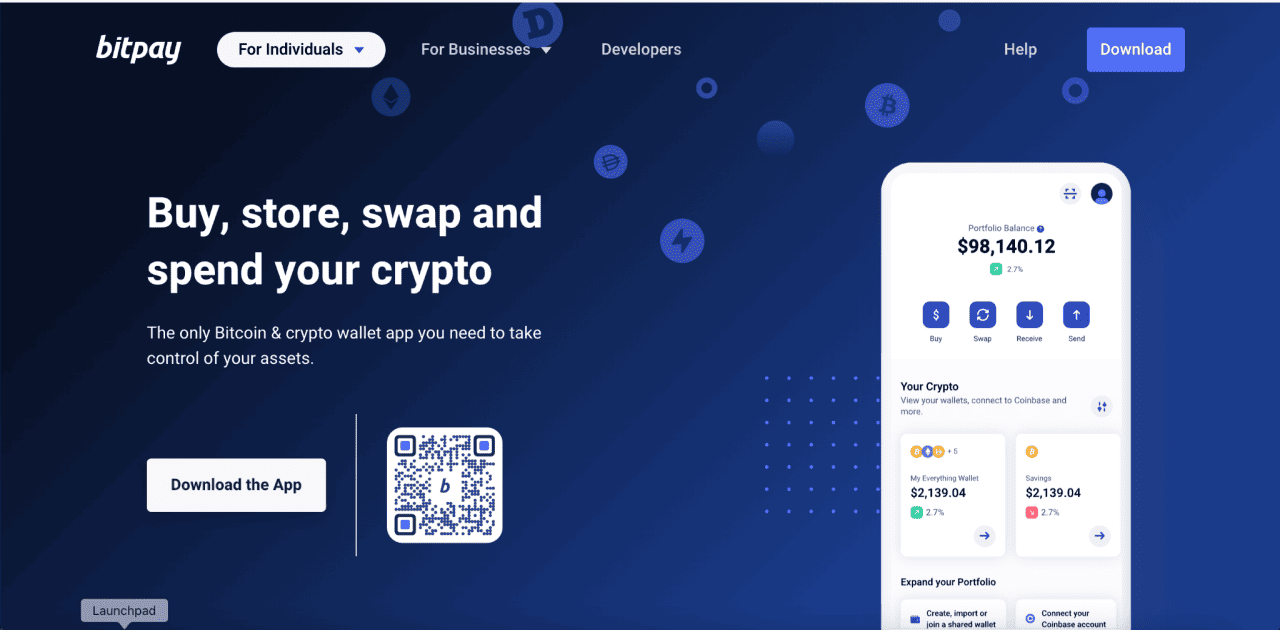

BitPay Wallet

It is a good choice for those looking to buy, store, swap, and spend Bitcoin and Bitcoin Cash. As a non-custodial wallet, it ensures that your private keys and funds are always under your control. Built on open-source code, BitPay Wallet allows for community testing and audits, enhancing its transparency and security.

- Security Features: The wallet uses multi-signature security, requiring multiple approvals for transactions, and stores private keys locally on your device, protecting them from online threats.

- Functionality: Users can manage multiple Bitcoin wallets, buy and sell Bitcoin easily, and purchase Amazon gift cards directly through the app. It also offers customizable wallet names and backgrounds.

- Integration Options: The wallet works with the BitPay Visa Card, allowing users to spend crypto at millions of locations. It supports secure payment requests too.

- Community and Support: BitPay has a strong reputation, with resources available for troubleshooting, making it user-friendly for all experience levels.

Crypto Wallets for Long-Term Holders and Investors

Crypto wallets play a crucial role for long-term holders and investors, offering security, convenience, and various features to manage digital assets effectively. Here are some top choices tailored for this purpose:

Ledger Nano X

The Ledger Nano X is a popular hardware wallet known for its excellent security and support for a wide variety of cryptocurrencies—over 5,000! It connects via Bluetooth, letting you manage your digital assets easily from your smartphone while keeping your private keys safe and secure.

- Security Features: This wallet works offline, meaning your private keys are never exposed to the internet. It includes a special secure chip to enhance protection and allows you to set up a PIN code and passphrase for extra safety.

- Functionality: With the Ledger Live app, you can quickly send, receive, and exchange cryptocurrencies. The app is user-friendly, making it easy to check your balance and track your transaction history.

- Integration Options: The Nano X connects with various decentralized finance (DeFi) platforms and apps, allowing you to stake, lend, and trade cryptocurrencies right from the wallet.

- Community and Support: Ledger has a strong community and provides many helpful resources, like tutorials and customer support, to assist you as you explore the world of cryptocurrency.

Trezor Model T

The Trezor Model T is a leading hardware wallet that offers strong security along with a simple design. It supports over 1,000 cryptocurrencies and features a color touchscreen for easy navigation, making it accessible for everyone.

- Security Features: This wallet uses cold storage to keep your private keys safe, meaning they’re never connected to the internet. It also provides multi-signature options and advanced features like passphrase protection to keep your funds secure.

- Functionality: You can easily manage your cryptocurrency directly on the wallet's touchscreen. It allows you to send and receive funds securely, verifying transactions right on the device.

- Integration Options: The Model T works well with various third-party wallets for managing NFTs and other digital assets, although you’ll need compatible apps for some tasks, like NFT management. It also allows you to stake certain cryptocurrencies right from the wallet.

- Community and Support: Trezor has built a solid reputation and offers extensive documentation and support to help you make the most of your wallet.

KeepKey

KeepKey is a straightforward hardware wallet that prioritizes simplicity while offering solid security. It supports major cryptocurrencies and is designed to be user-friendly, making it a good choice for beginners.

- Security Features: KeepKey keeps your private keys offline to protect them from online threats. It includes a recovery seed feature, allowing you to back up your wallet easily and securely.

- Functionality: Sending and receiving cryptocurrencies is easy with KeepKey's interface. You can also trade different digital assets using its connection with ShapeShift.

- Integration Options: You can connect KeepKey to other wallets that offer multi-signature transactions.

- Community and Support: KeepKey provides user guides and support resources to help you get started and manage your wallet effectively.

Paper Wallets

Paper wallets are a simple and secure way to store your cryptocurrency offline. They involve writing or printing your private keys on paper, keeping them completely separate from the internet.

- Security Features: Because they aren’t connected online, paper wallets are safe from hacking attempts. However, it’s important to store them in a secure place to prevent loss or damage.

- Functionality: You can create a paper wallet using trusted offline tools. To access the funds later, you’ll need to import or sweep the keys into a digital wallet.

- Integration Options: Paper wallets stand alone and don’t connect to other services, making them ideal for long-term storage rather than daily use.

- Community and Support: While there isn’t much ongoing support for paper wallets, there are many online resources to guide you in creating and managing them securely.

Crypto Wallets for DeFi and NFT Enthusiasts

Crypto wallets designed for DeFi and NFT enthusiasts offer a range of features that facilitate seamless interactions with decentralized finance platforms and NFT marketplaces. Here’s a look at some of the best options for those looking to dive into this vibrant ecosystem:

MetaMask

MetaMask is a popular wallet designed for Ethereum and its dApps (decentralized applications). It lets you manage ERC-20 tokens and NFTs easily. You can use it as a browser extension or a mobile app, making it accessible for everyone, from beginners to seasoned users.

- Special Features: It supports multiple networks, allowing you to swap tokens directly in the wallet. Plus, it connects seamlessly with various dApps, helping you explore DeFi (decentralized finance) services effortlessly.

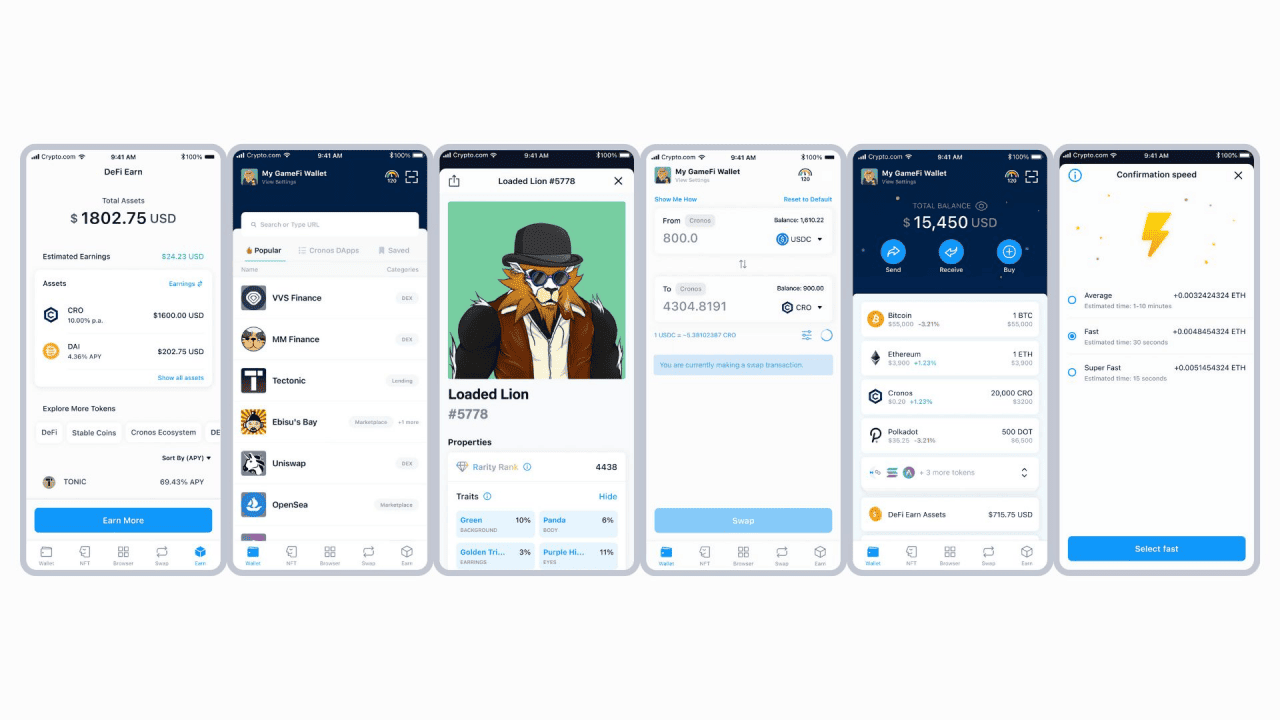

Crypto.com Wallet

The Crypto.com Wallet is part of the larger Crypto.com platform, where you can buy, sell, and trade cryptocurrencies. It supports a wide variety of digital assets and is great for managing your crypto portfolio.

- Special Features: You can earn rewards through staking and lending, and it even includes an NFT marketplace where you can buy and sell digital collectibles, making it perfect for NFT lovers.

Coinbase Wallet

Coinbase Wallet is a user-friendly, non-custodial wallet that lets you securely store a wide range of cryptocurrencies and NFTs. It’s separate from the Coinbase exchange, so you have full control over your private keys.

- Special Features: With support for over 5,500 crypto assets and a built-in DApp browser, you can easily explore various DeFi platforms right from the wallet, making it easy to manage your digital assets.

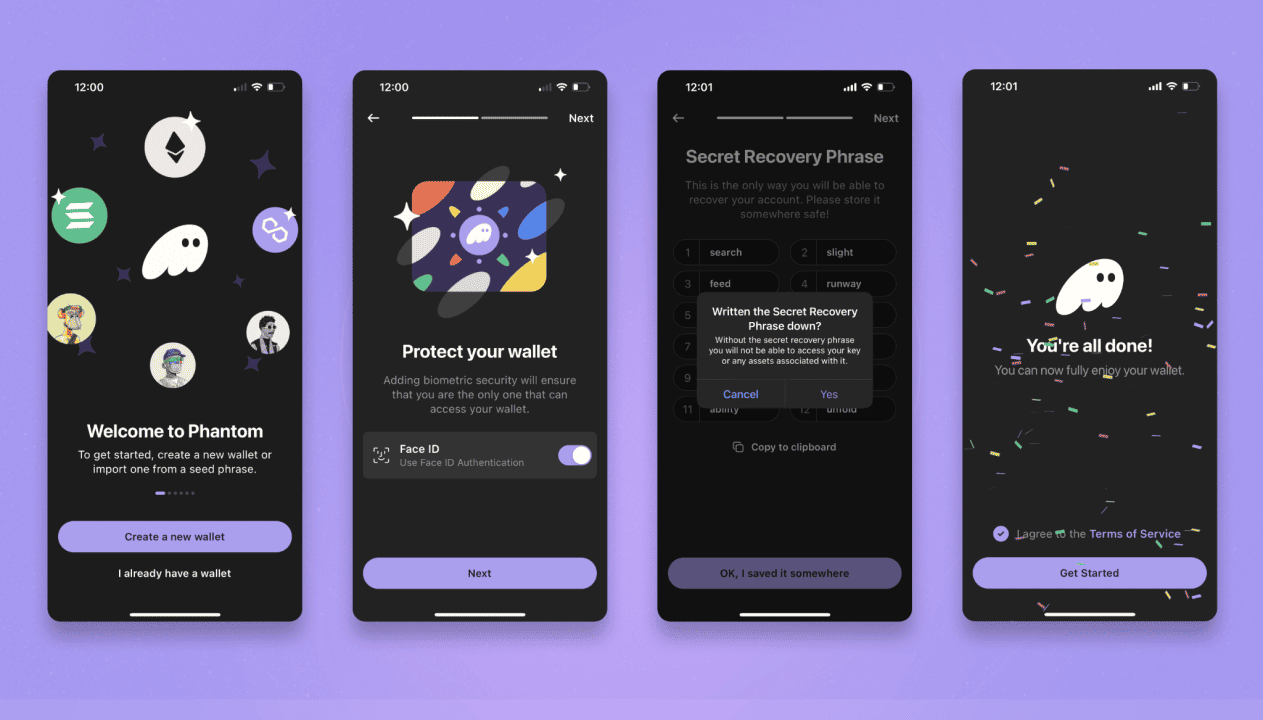

Phantom Wallet

Phantom is a self-custody wallet made specifically for the Solana blockchain. It’s known for its easy-to-use interface, allowing you to store, trade, and stake Solana-based tokens and manage NFTs effortlessly.

- Special Features: Phantom provides excellent NFT management tools and connects you to various DeFi platforms, making it a great choice for anyone interested in the Solana ecosystem.

Beyond Hot and Cold: Emerging Crypto Wallet Technologies

Emerging technologies are shaping the future of crypto wallets, extending beyond traditional hot and cold storage solutions. These innovations aim to enhance security, usability, and functionality for users navigating the evolving cryptocurrency landscape.Here’s an overview of some of the most exciting developments in crypto wallet technologies:

Multi-Chain Wallets: Why They Matter for a Decentralized Future

Multi-chain wallets simplify the management of cryptocurrencies by allowing users to store, send, and receive various digital assets from multiple blockchains in one convenient place. This approach offers numerous advantages:

- Seamless Transfers: Users can move assets directly between different blockchains without needing intermediaries or multiple exchanges, making transactions faster and often cheaper.

- Unified Management: By consolidating all cryptocurrencies in a single wallet, users can effortlessly track and manage their entire portfolio without juggling multiple apps.

- Access to DApps: Multi-chain wallets facilitate interactions with decentralized applications (dApps) across various networks, enabling users to engage with different blockchain ecosystems without the hassle of switching wallets.

To support these wallets, new protocols and standards are emerging. Cross-Chain Bridges, like ChainBridge and RenVM, enable seamless asset transfers between blockchains. Interoperability Standards from projects like Polkadot and Cosmos are designed to create frameworks for communication between different blockchains, simplifying cross-chain interactions. Decentralized Identifiers (DIDs) help users establish secure identities across multiple chains, enhancing asset management while maintaining privacy.

Notable examples include:

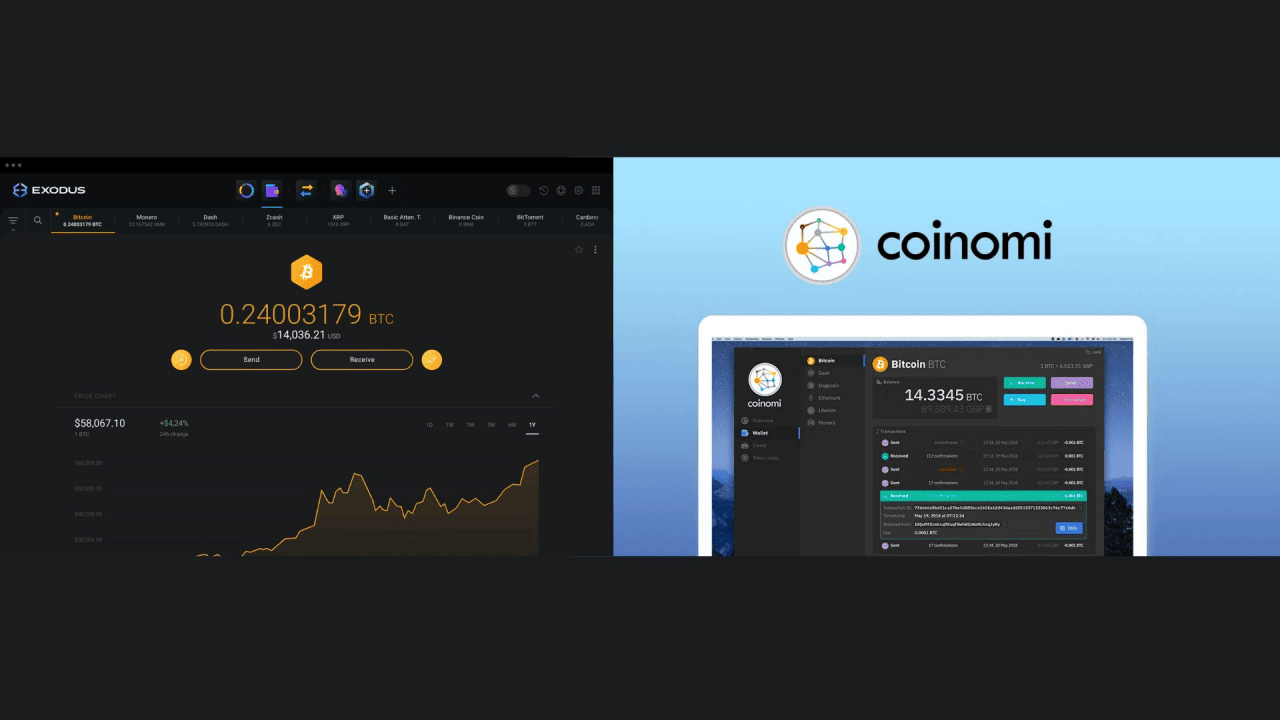

- Exodus Wallet: Known for its sleek design, it supports multiple blockchains, including Bitcoin, Ethereum, and Solana.

- Coinomi: One of the oldest multi-chain wallets, it supports hundreds of blockchains and thousands of tokens.

AI-Powered Wallets: Simplifying Security for Users

AI technologies are revolutionizing crypto wallets by enhancing user experience in various ways:

- Personalized Recommendations: AI analyzes user behavior to offer tailored suggestions for asset management and trading strategies.

- Intelligent Interfaces: AI improves wallet interfaces with intuitive navigation, automated transaction categorization, and smart alerts for price changes.

- User Education: AI-driven chatbots assist users through complex processes, helping them understand features and security practices.

In terms of security and efficiency, AI enhances wallets through:

- Fraud Detection: Machine learning algorithms analyze transaction patterns in real-time, identifying suspicious activities and enabling immediate alerts.

- Transaction Optimization: AI assesses network conditions to suggest the best times for trades or transfers, ultimately helping users save on transaction fees.

Notable example include:

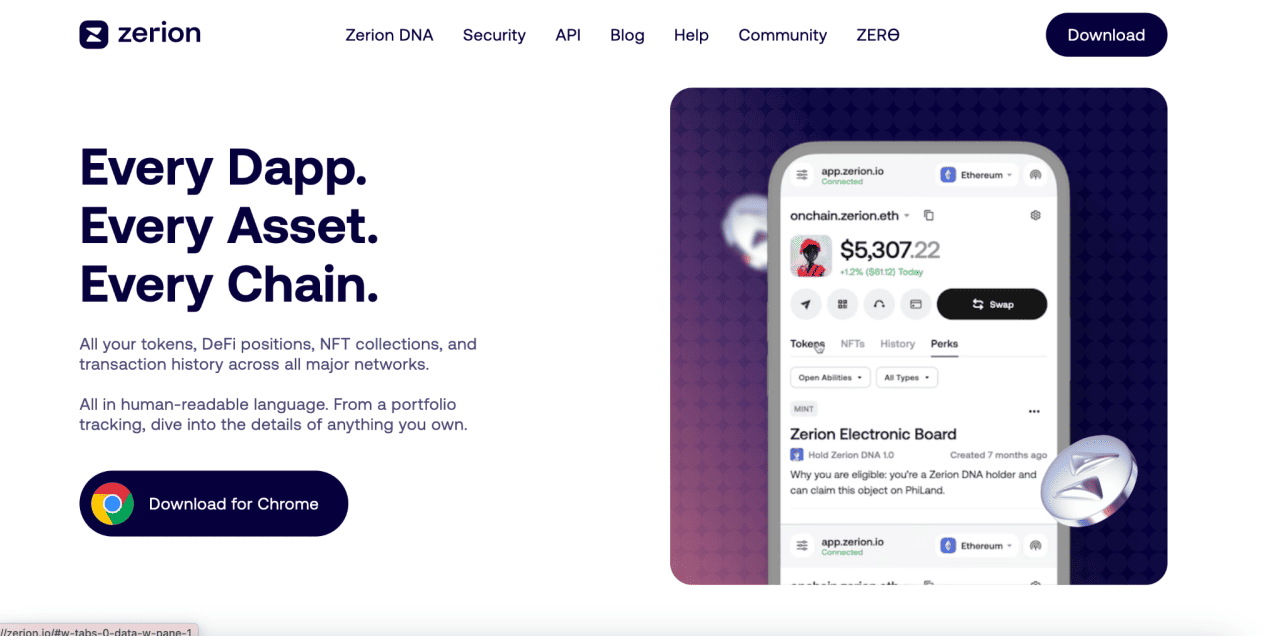

- Zerion Wallet: Uses AI to automatically track DeFi positions, providing users with real-time updates on their investments and rewards.

Wallets with Social Recovery Mechanisms

Social recovery mechanisms allow users to regain access to their wallets through trusted contacts instead of relying solely on a seed phrase. Here’s how they work:

- Guardian System: Users select trusted individuals (guardians) who hold necessary recovery information. If access is lost, the user can initiate recovery with input from these guardians.

- Enhanced Security: This approach offers more flexibility than traditional seed phrases, reducing the risk of permanent loss and ensuring that recovery assistance comes only from trusted contacts.

Social recovery is particularly beneficial in various scenarios:

- New Users: It simplifies access for those new to cryptocurrency, allowing recovery without managing complex seed phrases.

- Shared Accounts: In cases of shared wallets, social recovery promotes accountability by preventing any single person from having total control.

- Elderly or Vulnerable Users: Involving trusted family members or friends in the recovery process provides peace of mind for those who may struggle with complex phrases, making asset management less daunting.

Notable examples include:

- Argent Wallet: Allows users to set up guardians who can help recover access if needed.

- Gnosis Safe: Primarily a multi-signature wallet, it offers social recovery features that require multiple parties to agree before transactions are executed.

- Loopring Wallet: Incorporates social recovery mechanisms, enabling users to regain access through designated contacts.

What Others Miss: Hidden Pitfalls and Misconceptions About Crypto Wallets

While many users understand the basic functions of cryptocurrency wallets, several hidden pitfalls and misconceptions can put their digital assets at risk. Here’s a closer look at these often-overlooked issues, including real-world examples and warnings to help you navigate them safely.

1. Free Wallets Aren’t Really Free: Understanding the Trade-Offs

Many crypto wallets advertise themselves as "free," but the true cost often lies hidden in terms of privacy compromises, fees, and limitations. Here's what you need to know:

- Data Sharing Practices: Free wallet providers often collect and share personal data like email addresses, IP addresses, and transaction histories. This data is used to build user profiles for advertising or analytics. Some wallets may even share this information with third-party companies, often without the user's explicit consent.

- Warning: Pay attention to privacy policies. If you’re using a free wallet, ensure you understand what personal data is being collected and how it’s being used. Some services change their privacy policies over time, expanding data collection or sharing practices without informing users properly.

- Hidden Fees Impacting User Trust: While free wallets promise no charges, many of them still impose hidden transaction fees or withdrawal fees. These fees can vary depending on the network congestion or the cryptocurrency being transferred, leading to unexpected costs.

- Warning: Always check the fee structure before using a wallet. Even if a wallet advertises itself as free, be aware of potential withdrawal charges or varying transaction fees.

2. The Role of UX/UI in Crypto Adoption

The user experience (UX) and user interface (UI) of crypto wallets play a crucial role in ensuring that both beginners and experienced users can manage their assets without unnecessary complications.

- Why UX/UI Matters: A well-designed wallet interface can make it easier for users to understand and interact with their cryptocurrency. Poor UX/UI, on the other hand, can overwhelm users, especially those new to crypto, and create unnecessary barriers.

- Example: MetaMask is widely recognized for its intuitive UI design. It makes interacting with Ethereum-based assets and decentralized applications (dApps) straightforward. The wallet's onboarding process is simple, helping users set up their accounts and start managing their assets without confusion.

- Warning: Always choose a wallet that has a clean, intuitive design. Avoid wallets with overly complex or technical interfaces, as they might lead to costly mistakes, especially for new users.

3. Bridging Identity and Finance: Wallets with Decentralized Identity (DID) Integration

The integration of Decentralized Identity (DID) technology in crypto wallets is changing the way users manage their identities and interact with digital finance. With DID, you can control your identity securely, reducing the need to trust third-party platforms with personal data. Here's how it works:

- What is DID? A Decentralized Identity (DID) allows users to manage their identity across various online platforms without relying on centralized organizations. This system enhances privacy by ensuring that personal information is not exposed unnecessarily during verification processes.

- Example Case Study: SelfKey Wallet

SelfKey is a wallet that integrates DID technology. It allows users to create and manage a secure digital identity that they fully control. With this identity, they can easily access decentralized finance (DeFi) services without repeatedly entering sensitive information like their name, address, or phone number. The benefit? Users can engage with DeFi platforms while keeping their personal data private and secure. - Warning: While DID offers more privacy, it's crucial to secure your private key and backup. If you lose access to your DID or your private key, you might lose access to services or funds associated with that identity.

Key Takeaways:

- Don’t trust "free" wallets blindly: They may compromise your privacy and impose hidden fees. Always read the fine print and ensure you're aware of any hidden costs.

- Ensure a smooth user experience: A well-designed wallet can make all the difference. Look for wallets with intuitive interfaces and consider using established wallets with a reputation for security and ease of use.

- Leverage Decentralized Identity (DID) technology: If you value privacy and security, use wallets that integrate DID. However, always back up your credentials securely to avoid losing access.

By understanding these often-overlooked aspects of crypto wallets and following these guidelines, you can avoid potential pitfalls and manage your digital assets more securely.

Securing Your Crypto Wallet: Best Practices for 2024

As cryptocurrency adoption continues to grow, securing your crypto wallet has never been more crucial. With the rise of cyber threats and scams, implementing best practices for wallet security can protect your digital assets. Here are the top strategies to secure your crypto wallet in 2024:

1. Use a Hardware Wallet

- Choose Trusted Hardware Wallets: Select reputable hardware wallets like Ledger Nano X, Trezor Model T, or Ledger Nano S. These devices store your private keys offline, preventing exposure to online threats.

- Set Up Device Securely: During setup, disable the PIN recovery option and set a strong PIN code. Use a recovery phrase to back up your device, and ensure it's stored securely.

2. Create Multiple Copies

- Make at Least 2 Copies: Make multiple physical copies of your seed phrase and store them in separate, secure locations (e.g., safe deposit boxes in different banks, home safes). Never leave it in easy-to-access locations like drawers or under your keyboard.

- Avoid Digital Storage: Do not store your seed phrase on your computer, phone, or online. These devices can be hacked, and digital copies of seed phrases are at risk of being exposed. Use a metal backup to engrave or etch your seed phrase. Paper can degrade or be damaged in a fire or flood, while metal provides long-term durability.

3. Use a Password Manager (for Digital Storage)

- Choose a Reputable Password Manager: If you prefer digital storage, use a password manager with strong encryption like 1Password, Bitwarden, or LastPass.

4. Enable Two-Factor Authentication (2FA)

- Activate 2FA for Wallets: For wallets that support it, enable 2FA using apps like Google Authenticator or Authy. This adds an extra security step when logging in, ensuring only you can access your wallet.

- Avoid SMS-based 2FA: Use authenticator apps rather than SMS-based 2FA, as SMS can be intercepted or hacked.

5. Regularly Update Software

- Keep Wallet Software Updated: Regularly check for updates to your wallet software and hardware wallet firmware. Many updates address critical security vulnerabilities.

- Automatic Updates: Enable automatic updates when possible, so you never miss a security patch for your wallet application or device.

Conclusion

Choosing the right crypto wallet is more than just a storage solution; it’s about securing your future in the ever-evolving world of digital assets. Whether you prioritize security, usability, or compatibility with decentralized platforms, there’s a wallet tailored to your needs. By understanding the different types—hot, cold, custodial, non-custodial, and multi-signature—you can make an informed decision that balances convenience and security. Remember, always follow best practices like using hardware wallets, enabling 2FA, and keeping regular backups to ensure your assets are protected from emerging threats.

FAQs

What is the Best Crypto Wallet for Beginners in 2024?

The best wallet depends on your needs. Coinbase Wallet is user-friendly and connects to the Coinbase exchange. Trust Wallet is great for mobile users, while MetaMask is ideal for accessing decentralized applications (dApps).

How to Set Up a Crypto Wallet Step-by-Step

To set up a wallet, choose one that suits you, download the app or visit the website, and create an account. Make sure to write down your seed phrase for backup, set a strong password, and enable two-factor authentication for added security. You can then deposit cryptocurrency by transferring funds from an exchange.

Can You Have Multiple Crypto Wallets?

Yes, many users have multiple wallets. Using hot wallets for daily transactions and cold wallets for long-term storage enhances security and helps you manage your assets better.

Are Hardware Wallets Worth the Investment?

Yes, hardware wallets are worth the investment, especially for significant holdings. They store private keys offline, providing superior security against hacks compared to software wallets, making them a smart choice for protecting your assets.